what does general aggregate mean in an insurance policy

We hope you found this information helpful. After paying 1 million for the example claim above.

General Liability Insurance Cost Insureon

The general aggregate limit places a ceiling on the insurers.

. Most policy periods are one year. When you reach your aggregate limit your insurer will pay no additional claims during the policy period. So in any one occurrence the policy will pay out 1000000.

An insurance contract provision limits an insurers maximum liability for a series of losses in a given time eg a year or the entire contract period. A general aggregate sets the limits of your commercial general liability CGL policy. Umbrella insurance policy is an additional.

What Is Aggregate Insurance and Why Is There a Limit. 1 a limit in an insurance policy stipulating the most it will pay. Aggregate limits are commonly included in liability policies.

There can be any number of claims on a policy but the policy limit will be 2000000. Because its a sum total aggregate insurance can. Ad Fill Out 1 Easy Form Get 5 Free Competitive Quotes Within Minutes.

The aggregate limit in your commercial insurance policy is the maximum amount your insurer will reimburse you for all covered losses within the term of your policy. In commercial general liability insurance the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. Aggregate Excess Insurance.

The term is also known as general aggregate limit of liability which is the maximum amount of money an insurance company will pay for claims losses and lawsuits that happen during the active period of your policy typically one year. Under the standard commercial general liability CGL policy the general aggregate limit applies to all covered bodily injury BI and property damage PD. Sometimes called annual aggregate limit.

A general aggregate is the maximum limit of coverage which applies to commercial general liability insurance policy. The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term. Many insurance policies have what is called an aggregate limit.

The aggregate limit of liability is the total amount in dollars that you will be paid by your insurance policy. In the picture above the GENERAL AGGREGATE limit is 2000000. General Aggregate Limit the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures.

General Aggregate Limit the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. Aggregate excess insurance is. We have affordable contractor insurance.

Call us at 952-469-0425 or request an online quote today. Unsure about what aggregate insurance is and why there is a limit. An insurance policy that limits the amount that a policyholder has to pay out over a specific time period.

However other general liability coverage policies will have something along the lines of a 1000000 per occurrence limit and a 2000000 general aggregate limit excluding products-completed operations. An aggregate is the limit an insurance company will pay an insured for covered losses sustained during a set period of time. Aggregate 1 A limit in an insurance policy stipulating the most it will pay for all covered losses sustained during a specified period of time usually a year.

Under the commercial general liability insurance the general aggregate limit is applied to the covered bodily and property damage and all covered personal advertising injury. A general aggregate is a crucial term in commercial general liability insurance which is necessary for all policyholders to understand. If you have a very unfortunate year and somehow manage to reach the aggregate limit the insurance company will not pay anything out for future claims and the policy is effectively over.

General aggregate represents the maximum amount a policy pays out across all claims. On certain types of insurance coverage an aggregate limit is put in. We know that general aggregates can be confusing.

This means that in this example individual claims have a limit of 1000000 each while the total policy coverage for all claims made. Many insurance policies have what is called an aggregate limit. Using our example limits this policy pays up to 1 million for a single claim but cannot exceed that amount.

The general aggregate limit of an insurance policy is the maximum amount of money the insurer will. The top limit is an Each Occurrence Limit of 1000000. An aggregate limit is the maximum amount the policy is obligated to pay for all covered losses occurring during the.

While not often used in property insurance aggregates are sometimes included with respect to certain. Aggregate also is referred to as an aggregate limit or general aggregate limit. The general aggregate limit places a ceiling on the insurers.

The general aggregate limit in your commercial insurance policy refers to. In commercial general liability insurance the general aggregate is the maximum amount of money the insurer will pay out during a policy tenure. An aggregate limit is a total amount the insurance company is willing to pay out during the policy period.

Aggregate 1 a limit in an insurance policy stipulating the most it will pay for all covered losses sustained during a specified period of time usually a year. The aggregate insurance definition is the highest amount of money the insurer will pay for all of your losses during a policy periodthis period typically lasts for one year. Ad compare top 50 expat health insurance in indonesia.

The General Aggregate or policy limit is 2000000. The aggregate limit is usually double the occurrence limit. It may be definitive as in a general lifetime maximum for claims or it may be set annually like 500000 per year.

Under some commercial general liability CGL policies the general aggregate limit applies to all covered bodily injury BI and property damage PD except for injury or. A general aggregate limit is the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. Unlike a per-occurrence limit which limits the amount per claim a general aggregate limit can be exhausted through either two claims fifty claims or anywhere in between.

Overages must go toward an umbrella or excess insurance policy or result in out-of-pocket costs.

Producer S Guide Certificates Of Insurance In Film Wrapbook

General Liability Insurance Cost Insureon

Corona Kavach Is An Individual And A Family Insurance Policy That Was Launched On July 10 2020 And Offe Health Insurance Companies Insurance Policy Insurance

/modular-vs-manufactured-home-insurance-5074202_final-fdb217e866f84bdda6418d6c68e4c267.png)

Understanding Facultative Vs Treaty Reinsurance

The General Aggregate Limit What Is It Landesblosch

The General Aggregate Limit What Is It Landesblosch

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

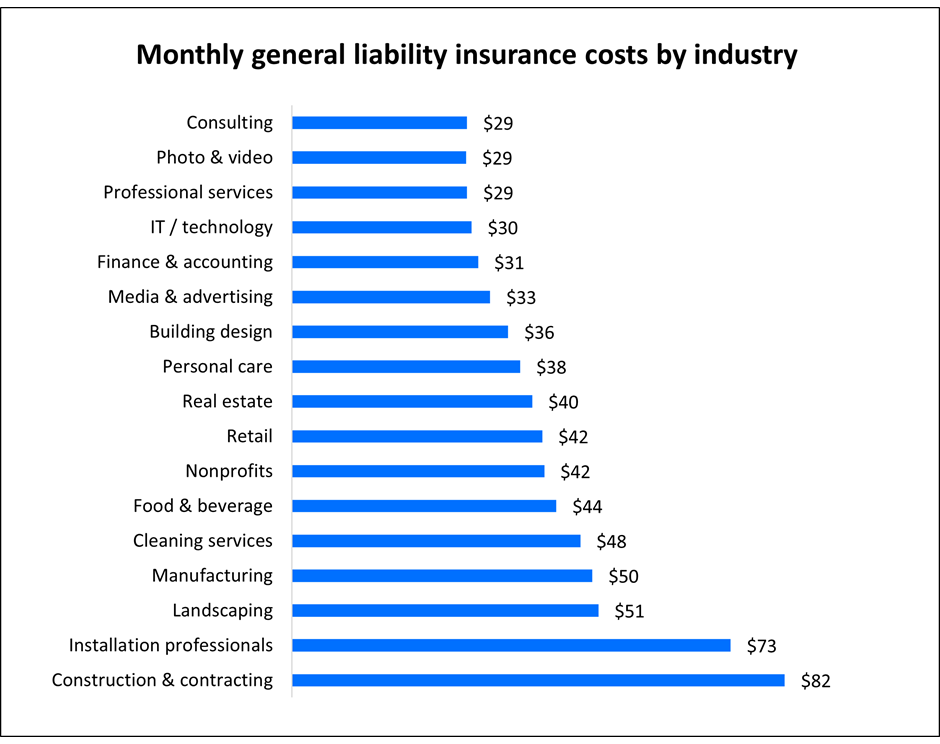

How Much Does General Liability Insurance Cost The Hartford

What Are Aggregate Limits And Per Occurrence Limits In My General Liability Insurance Policy

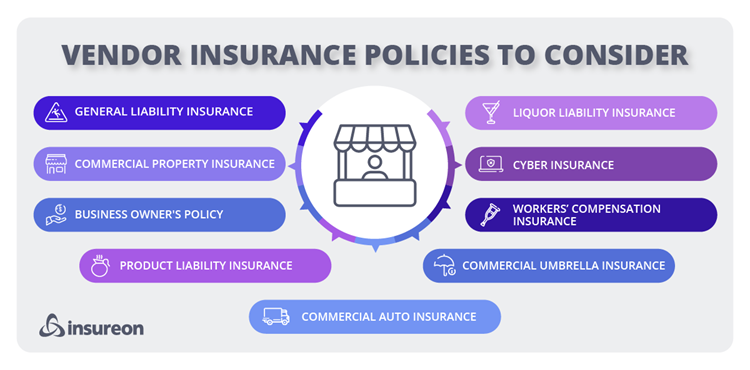

A Guide To Vendor Insurance Requirements Insureon

What Is General Liability Insurance Small Business Insurance Simplified

What Are Aggregate Limits And Per Occurrence Limits In My General Liability Insurance Policy

Vendors Endorsement Extend Coverage To Your Vendors

The General Aggregate Limit What Is It Landesblosch

Primary And Noncontributory Expert Commentary Irmi Com

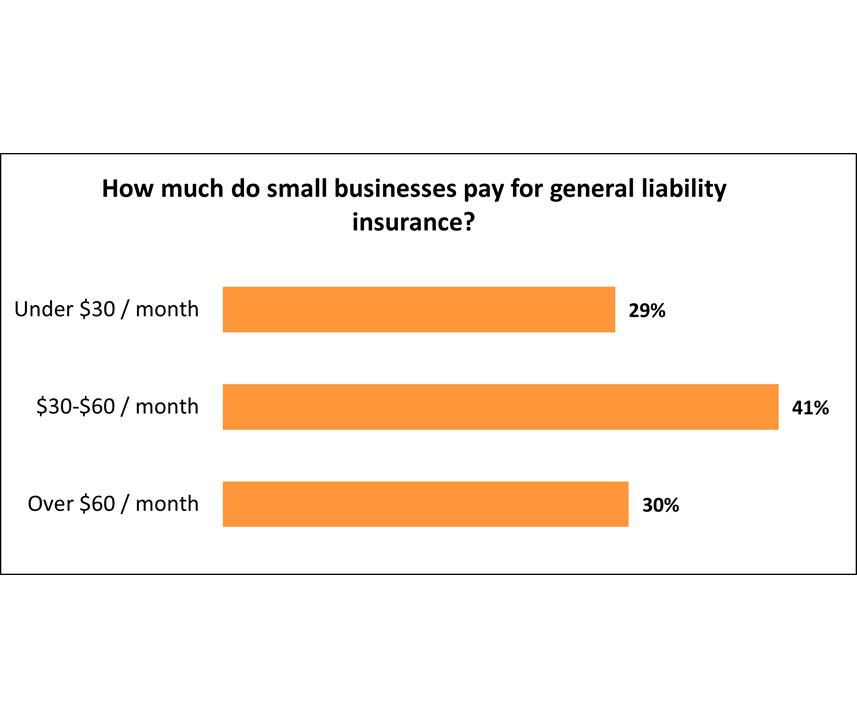

How Much Does General Liability Insurance Cost Commercial Insurance

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

:max_bytes(150000):strip_icc()/imitation-of-a-house-in-a-chain-on-a-lock-on-a-gray-piece-of-concrete-on-a-beige-pastel-background--1133455818-33c850555bb14795a46fade3d2e34a17.jpg)

0 Response to "what does general aggregate mean in an insurance policy"

Post a Comment